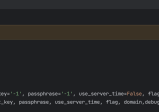

#!/usr/bin/env python

# -*- coding: utf-8 -*-

import cross_order as order

import time

def StochRSI(close, lengthRSI=14, lengthStoch=14, smoothK=3, smoothD=3):

"""

计算StochRSI(close),有5个参数,第1个为数据源

@param close: 数据源

@param lengthRSI: RSI参数

@param lengthStoch: Stoch参数

@param smoothK: K参数

@param smoothD: D参数

@return:

"""

# 计算RSI

lc = close.shift(1)

diff = close - lc

up = diff.where(diff > 0, 0)

down = -diff.where(diff < 0, 0)

ema_up = up.ewm(alpha=1 / lengthRSI, adjust=False).mean()

ema_down = down.ewm(alpha=1 / lengthRSI, adjust=False).mean()

rs = ema_up / ema_down

rsi = 100 - 100 / (1 + rs)

# 计算Stochastic

stoch = (rsi - rsi.rolling(window=lengthStoch).min()) / (rsi.rolling(window=lengthStoch).max() -

rsi.rolling(window=lengthStoch).min())

k = stoch.rolling(window=smoothK).mean()

d = k.rolling(window=smoothD).mean()

# 添加到data中

STOCHRSI = k * 100

MASTOCHRSI = d * 100

return STOCHRSI, MASTOCHRSI

def main():

print("任务开始时间:", time.strftime('%Y-%m-%d %H:%M:%S', time.localtime(time.time())))

for symbol in order.symbol_pool:

# 设置杠杆倍数

order.set_leverage(symbol=symbol, leverage='25')

# 15分钟

df = order.get_candlesticks(symbol=symbol, interval='15m', limit=str(181))

fastk, fastd = StochRSI(df['close'], 14, 14, 3, 3)

if (fastk.iloc[-2] or fastd.iloc[-2] < 20) and (

fastk.iloc[-1] or fastd.iloc[-1] >= 20):

order.up_cross_order(symbol=symbol, ordtype='market', message='StochRSI 策略做多')

elif (fastk.iloc[-2] or fastd.iloc[-2] < 80) and (

fastk.iloc[-1] or fastd.iloc[-1] >= 80):

order.down_cross_order(symbol=symbol, ordtype='market', message='StochRSI 策略做空')

time.sleep(2)

print("任务结束时间:", time.strftime('%Y-%m-%d %H:%M:%S', time.localtime(time.time())))

if __name__ == '__main__':

print("程序运行时间:", time.strftime('%Y-%m-%d %H:%M:%S', time.localtime(time.time())))

main()

上一篇