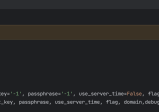

#!/usr/bin/env python

# -*- coding: utf-8 -*-

import talib

import cross_order as order

import time

import pandas as pd

def LON(df, n=10):

"""

钱龙长线指标是一种描述当前趋势的指标,相比均线只使用收盘价而言,钱龙长线指标在描述趋势时,还考虑到了最高价、最低价、成交量对趋势的影响。

最常用的使用方法是,LON指标上穿0线时做多;LON指标下穿0线时做空。

@param df: 数据源

@param n: 时间

@return:

"""

lc = df['close'].shift(1)

a = (df['high'].rolling(2).max() - df['low'].rolling(2).min()) * 100

vid = df['volume'].rolling(2).sum() / a

rc = (df['close'] - lc) * vid

long = rc.cumsum()

dif = long.ewm(com=9, adjust=False).mean()

dea = long.ewm(com=19, adjust=False).mean()

lon = dif - dea

return pd.DataFrame({'lon': lon, 'lonma': lon.rolling(n).mean()}, index=df.index)

def main():

for symbol in order.symbol_pool:

print("任务开始时间:", time.strftime('%Y-%m-%d %H:%M:%S', time.localtime(time.time())))

# 设置杠杆倍数

order.set_leverage(symbol=symbol, leverage='18')

# 获取标的的最新价

df = order.get_candlesticks(symbol=symbol, interval='4H', limit='200')

close = df['close'].values

lon = LON(df, 10)

# 做多止盈价格=委托价+atr

slpx = close[-1] * 1.008

# 做空止盈价格=委托价-atr

tppx = close[-1] / 1.004

print(

'重要参数:\n币种:{}\n当前价格:{:.2f}\nlon值:{:.2f}\nlonma值:{:.2f}\n止盈价格:{:.2f}\n止损价格:{:.2f}'

.format(symbol, close[-1], lon['lon'].iloc[-1], lon['lonma'].iloc[-1], slpx, tppx))

if lon['lon'].iloc[-1] < 0:

if lon['lon'].iloc[-2] > lon['lonma'].iloc[-2] and lon['lon'].iloc[-1] < lon['lonma'].iloc[-1]:

print('LON指标下穿0轴时做空,市价单卖出')

order.down_cross_order(symbol=symbol, message='LON指标下穿0轴时做空,市价单卖出')

elif lon['lon'].iloc[-1] > 0:

if lon['lon'].iloc[-2] < lon['lonma'].iloc[-2] and lon['lon'].iloc[-1] > lon['lonma'].iloc[-1]:

print('LON指标上穿0轴时做多,市价单买入')

order.up_cross_order(symbol=symbol, message='LON指标上穿0轴时做多,市价单买入')

time.sleep(5)

print("任务结束时间:", time.strftime('%Y-%m-%d %H:%M:%S', time.localtime(time.time())))

print("-----------------------------------v----------------------------------------")

if __name__ == '__main__':

print("-----------------------------------^----------------------------------------")

main()

上一篇